Currently, China's fastener production accounts for one-quarter of the global output, making it the largest fastener producer in the world. The market size of fasteners and precision machining parts is mainly determined by the market demand in their downstream application fields. The application fields of fasteners and precision machining parts are very extensive, covering civilian areas such as automobiles, household appliances, electronics, and medical devices, as well as high-end areas like aerospace and precision instrument manufacturing. According to data, in 2022, China's automotive fastener industry produced approximately 3.679 million tons, with a demand of about 2.891 million tons, and an average price of around 31,400 yuan per ton.

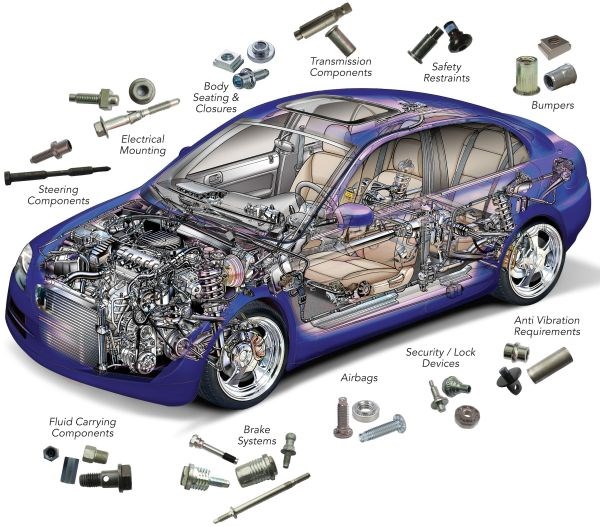

Generally, fasteners specifically used in automobiles are called automotive fasteners.

Automotive fasteners are widely categorized and can be divided into different types based on their use and position, such as bolts and nuts, screws and studs, bolt and nut assemblies, nut locking devices, screw and nut assemblies, spring washers, and cotter pins, among others. These fasteners play a crucial role in the automotive structure, such as connecting important components, securing light-load parts, providing additional protection, and offering anti-vibration functions. Specific examples include engine bolts, wheel hub nuts, door screws, brake studs, turbo bolts, and nut locking washers, each playing an essential role in ensuring the structural integrity and safe operation of vehicles.

Automotive Industry Chain

The upstream of the automotive fastener industry primarily involves raw materials such as steel, non-ferrous metals, and rubber. As crucial components of automobiles, automotive fasteners are mainly used in vehicle manufacturing and automotive repair. China's automobile sales have consistently been on the rise, and the growing new car market has expanded the downstream market space for automotive fasteners. Additionally, the demand for automotive fasteners in the automotive repair and auto parts markets is also substantial. Overall, both the new and existing markets for automotive fasteners in China have good expansion potential. The continuous development of the automotive industry positively stimulates the growth of the automotive fastener industry. According to data, China produced approximately 22.1209 million vehicles in 2022.

Analysis of the Global Automotive Fastener Industry Development Status

As the complexity of automotive design continues to increase, the importance of automotive fasteners becomes even more pronounced. The future demand trends emphasize high quality and durability. Technological advancements play a crucial role in transitioning traditional fasteners to multifunctional, high-precision automotive components. The new era of vehicle manufacturing demands automotive fasteners that are economical, easy to use, capable of replacing mechanical fasteners, and able to connect rubber, aluminum, and plastic components effectively.

Based on this forecast, it is easy to foresee that chemical fastening methods (including adhesives), "quick-connect" solutions, or self-locking fastening solutions will emerge and gain popularity. According to data, the global automotive fastener industry market size was approximately 39.927 billion USD in 2022, with the Asia-Pacific region accounting for the largest share at 42.68%.

Analysis of the Current Development Status of China's Automotive Fastener Industry

As China's manufacturing industry continues to develop and upgrade, the domestic industry still struggles to meet the high-strength, high-precision fasteners required by national machinery equipment industries such as automobiles and aircraft, relying significantly on expensive imported materials. There is a substantial value-added difference between domestic and foreign fasteners. However, driven by the good development of the domestic automotive market and the increasing demand for new energy vehicles, the industry market size has been rising annually. In 2022, the market size of China's automotive fastener industry was approximately 90.78 billion yuan, with a production value of around 62.753 billion yuan.

In recent years, the fastener industry itself has shown trends of specialization, clustering, and conglomeration. Over the past decade, China's fastener industry has developed rapidly, with continuous growth in production. Currently, China's fastener production accounts for one-quarter of the global output, making it the largest fastener producer in the world. The market size of fasteners and precision machining parts is mainly determined by the market demand in their downstream application fields, which are extensive and cover civilian areas such as automobiles, household appliances, electronics, and medical devices, as well as high-end areas like aerospace and precision instrument manufacturing. According to data, in 2022, China's automotive fastener industry produced approximately 3.679 million tons, with a demand of about 2.891 million tons, and an average price of around 31,400 yuan per ton.

Future Development Trends of China's Automotive Fastener Industry

- Technological Innovation and Intelligence

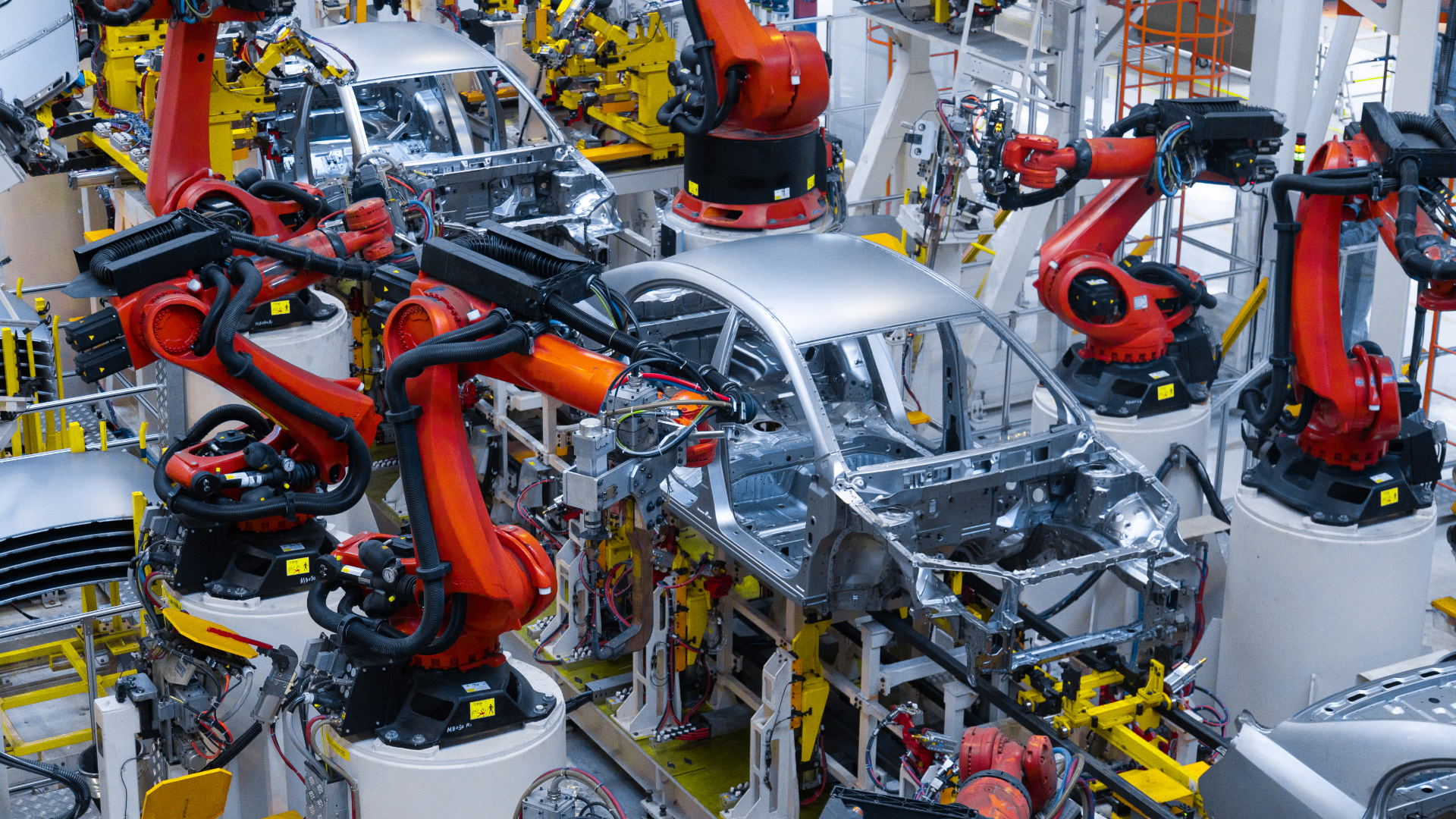

With the continuous development of the automotive manufacturing industry, the fastener industry will also embrace more technological innovations. The application of intelligent, digital, and advanced manufacturing technologies will become key trends to improve production efficiency, quality control, and product performance.

- Lightweighting and Material Innovation

The increasing demand from automakers to reduce vehicle weight will drive the automotive fastener industry towards the development of lighter, stronger, and more durable materials, such as high-strength alloys and composite materials.

- Environmental Protection and Sustainable Development

The fastener industry will place greater emphasis on environmental protection and sustainable development. The adoption of renewable materials, reduction of energy consumption, and decrease in waste and emissions will become the main directions for industry development.

- Autonomous Driving and Electrification

As autonomous driving technology and electric vehicles become more prevalent, the demand for high-performance and highly reliable fasteners will increase. Additionally, the unique design and engineering requirements of electric vehicles may lead to the development and adoption of new types of fasteners.

- Smart Manufacturing and Automation

The widespread application of smart manufacturing and automation technologies will enhance production line efficiency and reduce human errors. The use of machine learning and artificial intelligence is expected to optimize production planning and quality control.

Post time: Jun-17-2024